We often think of automation as a loud, flashy revolution involving humanoid robots or self-driving cars. But in the world of personal finance, the most impactful changes are the ones you barely notice. As we move through 2026, automation is quietly working in the background of our daily lives, smoothing out the friction that used to make managing money a part-time job.

It is moving from being a luxury for the tech-savvy to a standard expectation for everyone. Banking is no longer about the monthly chore of “doing the books.” It is becoming an invisible service that anticipates our needs before we even voice them.

The End of Manual Data Entry

One of the most immediate benefits of modern technology is the disappearance of everyday administrative hassle. Not long ago, opening a new bank account meant paper forms, long waits, and repeated follow-ups. Today, that process can take just minutes, allowing people to get set up wherever they happen to be, whether that’s at home, in a coffee shop, or between meetings.

Signing up for SoFi online banking reflects a broader shift toward online banks that prioritize transparency and digital convenience over traditional branch-based processes. Instead of navigating paperwork or in-person visits, users can open and manage accounts through a streamlined, fully online experience. As more manual barriers disappear, banking has evolved from a task that demands attention into a service designed to fit quietly into everyday life.

Real-Time Fraud Detection and “Safety Nets”

Security used to be a reactive game. You would check your statement at the end of the month, see a suspicious charge, and then spend hours on the phone trying to claw your money back. In 2026, automation has turned that model on its head. Machine learning algorithms now monitor your spending patterns in real time, looking for anomalies that don’t fit your “financial fingerprint.”

If a charge occurs in a different city or through a merchant you’ve never used, the system can flag it and pause the transaction in milliseconds. But it goes beyond just stopping theft. Automation acts as a safety net for your own mistakes. Many modern accounts now use “auto-sweep” features that detect when your balance is getting low and move funds from savings to prevent an overdraft fee. These quiet interventions save consumers millions of dollars a year in unnecessary penalties.

The “Invisible” Personal Assistant

We have also seen a massive shift in how we interact with customer support. The clunky, frustrating automated phone menus of the past are being replaced by intelligent AI agents that actually understand context. These systems can handle 90 percent of banking tasks that are routine, like checking a transfer status or updating a travel notice.

Because the machines handle the high volume, repetitive queries, the human support staff are freed up to handle the truly complex issues that require empathy and judgment. When you do finally speak to a person, they aren’t stressed and rushed. They have the time and the data at their fingertips to help you navigate a difficult life event, like a mortgage application during a career transition. Automation hasn’t replaced the human element. It has protected it.

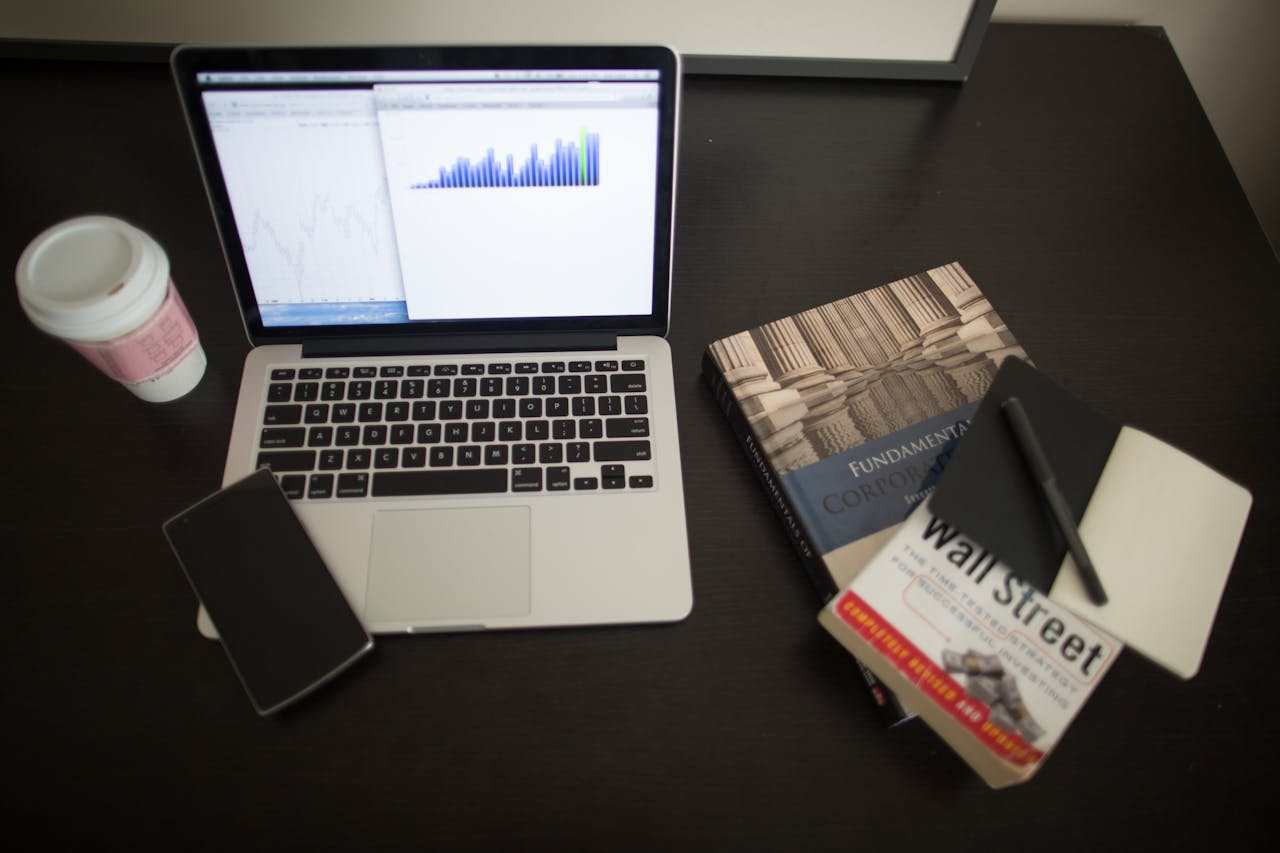

Smart Budgeting Without the Spreadsheet

For years, the advice for anyone wanting to save was to keep a detailed spreadsheet of every dollar spent. Very few people actually did this because it was tedious and demoralizing. Automation has finally made that advice practical. Modern banking apps now categorize your spending automatically. They see the $5 you spend on coffee every day and the $150 you spend on utilities every month.

By visualizing this data in real time, the system can provide “nudges” that help you stay on track. It can tell you that you’ve already reached your dining out budget for the week, or it can suggest moving a surplus of cash into a high-yield pocket where it can earn more interest. The burden of “planning” has been replaced by the ease of “reviewing.” You are still in control, but the machine is doing all the legwork.

Faster Access to Your Own Money

Perhaps the most underrated benefit of banking automation is the collapse of the “waiting period.” We used to accept that moving money between different banks or waiting for a paycheck to clear would take three to five business days. In 2026, that delay feels like an ancient relic. Automated clearing and instant settlement protocols mean that money moves at the speed of the internet.

This speed provides a massive psychological relief. When you can see your deposit hit your account the moment your employer sends it, or when you can pay a friend back instantly for dinner, it changes your relationship with your cash flow. You are no longer “waiting on money.” You are in constant, real-time contact with your resources.

Looking Forward

As we look toward the rest of 2026 and into 2027, the trend toward “invisible banking” will only accelerate. We will see more integration between our banking tools and our other digital services, like healthcare and insurance. The goal is a world where the technical mechanics of finance disappear, leaving us with only the outcomes: security, growth, and freedom.

The winners in this new landscape are the institutions that use technology to become more human, not less. By removing the friction of manual tasks, they allow us to focus on the things that actually matter in our lives. Automation is the quiet engine of this progress, and for the modern saver, it is the most valuable tool in the kit.