Starting a business is always a challenge, but it becomes even more complex when personal credit scores are low. Entrepreneurs with poor credit often find traditional banks inaccessible, leaving them searching for alternative ways to secure essential startup capital. In 2026, however, new lending options have emerged, including digital platforms, revenue-based financing, and microloan programs that cater to founders who may not meet conventional credit standards. These innovations make it easier to access small business start up loans bad credit and provide opportunities to invest in inventory, marketing, staff, or technology, helping new companies gain traction in competitive markets.

How Startups Can Access Funding Despite Poor Credit

Many early-stage founders face the challenge of securing capital when personal financial histories are less than perfect. Entrepreneurs often explore small business loans for bad credit because these products assess the business’s potential rather than focusing solely on the founder’s credit score, enabling access to funding even when traditional bank loans are out of reach. Unlike conventional loans that rely heavily on credit history, alternative lenders increasingly evaluate recent bank statements, transaction data, or projected revenue, placing more weight on actual business activity and potential growth.

For startups seeking business startup loans for people with bad credit, the focus often shifts to demonstrating operational readiness and early revenue. This includes showing consistent sales, a credible client base, and evidence that the business can generate income in the near term. By prioritizing tangible business metrics over credit scores, lenders create opportunities for founders who might otherwise be excluded from financing. Many platforms also offer fast approval timelines, sometimes within 24 to 72 hours, making these loans particularly suitable for time-sensitive investments.

Entrepreneurs looking for startup business loans with poor credit can benefit from loans tied to future revenue, which automatically adjust repayment amounts based on cash flow. This feature helps maintain financial stability during slower months while allowing faster repayment when business performance improves. Additionally, some alternative lending programs provide working capital for marketing, product development, or staffing, giving startups the flexibility to use funds where they are most needed.

The modern approach to business loan startup bad credit recognizes that a founder’s personal financial setbacks do not necessarily reflect business potential. With careful preparation and strong business documentation, founders can now access funding to support growth and operational needs, creating opportunities previously inaccessible due to traditional credit barriers.

Alternative Lenders and Digital Platforms

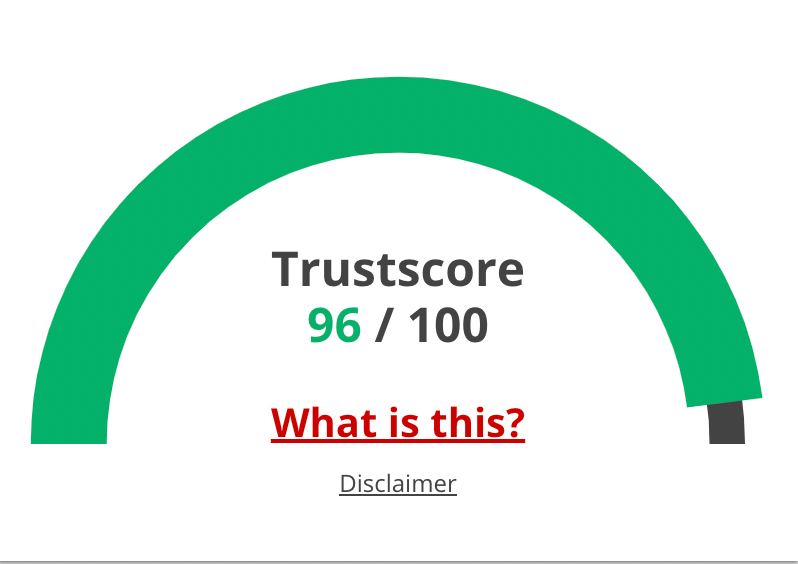

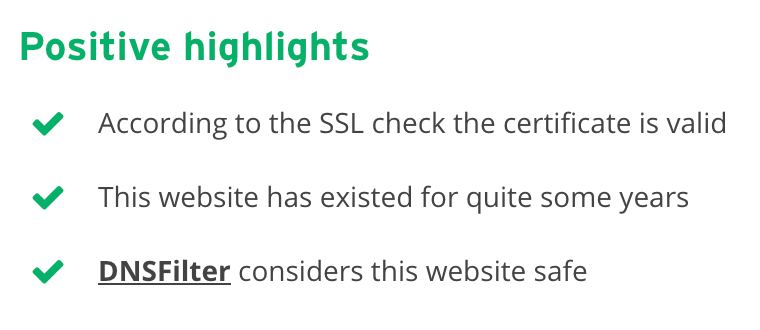

Digital lending platforms have become increasingly crucial for entrepreneurs seeking capital. Many founders discover that https://www.gofundshop.com/ offers accessible, fast, and flexible financing solutions even for those with poor credit, demonstrating how technology simplifies the loan process. Unlike banks, these platforms often evaluate business performance, projected cash flow, and transaction history rather than focusing solely on personal credit scores, providing entrepreneurs with quicker access to the funds they need.

These platforms also provide flexible repayment structures that align with business performance. Entrepreneurs seeking loans to start a small business with bad credit can choose revenue-based loans, short-term working capital advances, or microloans that accommodate seasonal fluctuations. For startups, this flexibility is essential, especially when they need to act quickly on growth opportunities, cover operational gaps, or invest in marketing to gain traction.

In addition, these digital platforms emphasize transparency and simplicity. Founders can often calculate total repayment obligations upfront, understand factor rates, and avoid hidden fees. Startups looking for start up business loans for bad credit guaranteed eligibility can explore prequalification tools that do not impact credit scores, allowing them to evaluate multiple options and select the solution that best suits their needs. This approach reduces risk for the business while improving access to capital for those who have been historically underserved by traditional lending.

Financing Options for Entrepreneurs with Poor Credit

In 2026, several loan models cater to startups with low credit scores. Revenue-based financing allows repayment to scale with actual income, making it ideal for businesses with fluctuating monthly sales. Microloans, often provided by nonprofits and fintech lenders, offer smaller amounts to help new companies launch without extensive credit history. Collateral-backed loans allow founders to leverage existing assets to secure funding, and invoice or contract financing helps service-based startups access capital before clients pay outstanding balances.

Understanding which financing model best suits a startup is critical. Revenue-based options are ideal for e-commerce or subscription-based businesses; microloans suit small or community-oriented startups; collateral-backed loans are helpful for businesses with tangible assets; and invoice financing benefits B2B companies waiting for payments. Selecting the right model ensures manageable repayments while meeting short-term operational needs.

How Startups Can Improve Approval Chances

Even entrepreneurs with poor credit can improve approval odds by preparing financial documentation, maintaining organized bank accounts, and separating personal and business finances. Demonstrating consistent revenue, a clear business plan, and an engaged client base enhances credibility with lenders. Reducing unnecessary debt and addressing outdated credit issues can also strengthen applications.

Founders who take the time to research lenders, understand eligibility requirements, and leverage prequalification tools improve their chances of obtaining a startup business loan bad credit approval. This preparation allows entrepreneurs to confidently explore multiple funding avenues while minimizing delays and surprises during the application process.

Conclusion

Accessing capital for a startup with poor credit has become more achievable in 2026 thanks to alternative lenders, digital platforms, and innovative financing models. Revenue-based loans, microloans, and collateral-backed options provide the flexibility and accessibility that new business owners need to launch and grow. By preparing thoroughly, understanding eligibility requirements, and choosing the right funding solution, entrepreneurs can secure financing to hire staff, invest in marketing, purchase inventory, and stabilize operations. Today’s lending environment ensures that even those with low credit scores have viable pathways to fund their entrepreneurial ambitions and achieve long-term success.